An Unbiased View of M&a Crm: Best M&a Crm Software

Wiki Article

The Definitive Guide for M&a Crm: Best M&a Crm Software

Table of ContentsM&a Crm: Best M&a Crm Software Can Be Fun For EveryoneAbout M&a Crm: Best M&a Crm Software7 Easy Facts About M&a Crm: Best M&a Crm Software DescribedGetting The M&a Crm: Best M&a Crm Software To WorkNot known Details About M&a Crm: Best M&a Crm Software

A few of the largest business mergers in history can highlight the extent of these deals and what companies stand to gain from experiencing the process - M&A CRM: best M&A CRM Software. When mergers reach this scale, federal governments obtain entailed, as the causal sequence of the merger can shock whole economic climates. This merger happened in 2000 and began the enormous debt consolidation of access provider.Time Warner was valued at $164 billion and among the largest wire business in the United States. This merging placed 2 powerhouses together, as well as the brand-new company created the roadmap for making use of wire facilities to rapidly and also considerably boost web access and also efficiency. This is another significant merger that happened in 2000.

Originally, Warner-Lambert was intending to offer to a various company, American Residence Products. That offer fell down, as well as Pfizer swooped in to complete a merger of its own. The merger went via for $90 billion, and also both firms were able to combine profits for production and also distribution of the cholesterol medicine called Lipitor.

M&a Crm: Best M&a Crm Software - Questions

These were already two of the biggest oil refinery and distribution business in the world. Their merger consolidated those resources, and also the effect was so fantastic that it altered the cost of crude oil permanently. The Disney and Fox merger was introduced in 2019 to the song of $52.

On January 4, 2022, Oracle introduced that it has actually gotten in into an arrangement to obtain Verenia's Internet, Suite CPQ company. This acquisition will certainly bring Web, Collection clients native configure, price and quote (CPQ) capability to make it possible for fast and precise guided marketing. Verenia's non-Net, Suite CPQ and also CRM line of product and also consumers are maintained by Verenia LLC.

Some Known Factual Statements About M&a Crm: Best M&a Crm Software

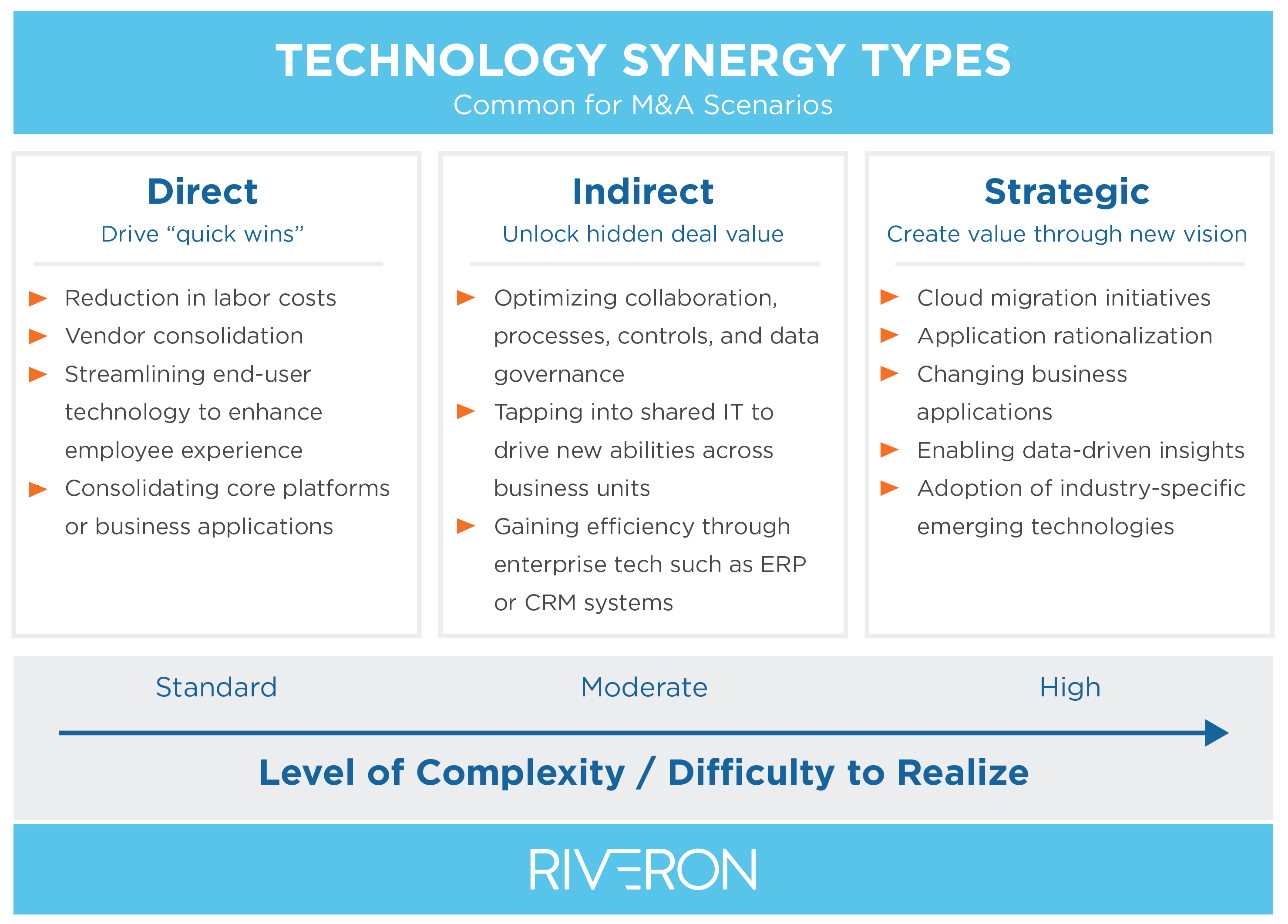

Info Modern Technology (IT) is no much longer a price center or division for most contemporary companies; it is the really core of a company's method., we looked at just how IT is Read More Here a key to recognizing the potential value motorists in mergings as well as acquisitions (M&A).70-90 percent of mergers fail to bring the value anticipated1. Half of the harmonies readily available in a merger are highly associated to IT3.

Top Guidelines Of M&a Crm: Best M&a Crm Software

Guarantee you comprehend the framework as well as area of the information that will certainly require to be transitioned. Assigning information owners by place and data you can look here kind (customer, vendor etc.) can typically help to make sure that absolutely nothing is missed. Guarantee you have testing methodologies as well as criteria agreed as you start the shift to make certain a high quality result.is changing the characteristics of M&A purchases. IT made use of to represent an expense that required to be handled as well as managed as 2 companies integrated. Today, IT and also electronic abilities are frequently the driving force behind the transaction. Also when an acquisition centers around a company's various other eye-catching possessions, digital abilities can supply a substantial resource of extra offer value, especially for legacy companies still having a hard time to catch up to digital citizens and the next page more highly innovative as well as established players in their corresponding markets.

Together with innovation value, acquirers have to likewise identify the possible innovation threats as they conduct their due persistance. Some services carry threat in the form of large IT projects that have actually resources funding devoted for years right into the future (M&A CRM: best M&A CRM Software). Not just must a potential acquirer examine business instance for these projects, however it should likewise review the ability of the business to deliver against the plan.

The Best Guide To M&a Crm: Best M&a Crm Software

In a recent transaction in the chemicals industry, the purchase target was a couple of months right into a multiyear ERP upgrade, with the huge bulk of the financial investment still ahead. Had the proper due persistance not been done, the acquirer would certainly have been encountered with a huge, unexpected hit to its financials.

Combination leaders must work closely with technology experts and organization or useful leaders to recognize where technology is required to meet the offer reasoning and to rapidly chart a program to integration. The integration plan will certainly be a clean-sheet plan, lined up with all essential stakeholders, covering the end-state solution, jobs, resourcing, and financial investments needed to deliver the modern technology part of the assimilation.

Report this wiki page